All Categories

Featured

Table of Contents

Startups are high-risk ventures with a high chance of failure. The recognized investor limitation tries to ensure that only investors with the sufficient methods to absorb a full loss and the sophistication to comprehend that risk are permitted to spend. Financiers simply need to fulfill the requirements defined in Policy 501(a) of Policy D of the Securities Act of 1933 to be considered a recognized capitalist.

Because of this, there are too lots of entities that can receive me to checklist right here (and plus it would birthed you to fatality). Typically, for an entity to certify as an approved investor it requires to be a defined entity that is regulated, such as a financial institution, insurance provider, financial investment business, investment consultant, or broker-dealer, or it has properties or financial investments going beyond $5 million and it wasn't created for the purpose of acquiring the safeties being supplied, or all of its equity owners are certified investors.

Speak to your attorney regarding which exceptions apply in your case. The most typically utilized exceptions entail sales to certified capitalists, however the actions you are required to require to verify the status of your capitalists can vary based on the particular exemption you mean to make use of. At a minimum, your investors must confirm that they are recognized capitalists.

Fidelity has actually made an available for you to use with your investors. If you are elevating funding with the sale of protections to certified capitalists, you most likely likewise need to submit paperwork pertaining to your exemption - private placement accredited investor leads list. This is most likely to include a Form D filing with the SEC (called for within 15 days of your first sale) and an evaluation of state policies in each state the offering is made

Investor Status

This recap is planned to give a fast recommendation for potential participants, but does not constitute lawful advice and might run out date at any moment. Each member of Toniic bears obligation for ensuring its compliance with the capitalist certification needs of every jurisdiction to which that member is subject.

In enhancement to rules surrounding public offering, PRC laws control Chinese outgoing investments. PRC laws and policies have actually not given the specific procedures for Chinese specific investors to make their investments in any type of non-financial entities included outside China. As an outcome, currently only Chinese corporate capitalists might be able to invest in a foreign enterprise.

Generally, an outbound purchase needs to be approved by, or filed with, the National Development and Reform Compensation (NDRC), the Ministry of Business (MOFCOM), and State Management of Forex (SECURE), or their local counterparts. If State-owned ventures are included, the authorization of the State-owned Possessions Guidance and Administration Compensation may likewise be required.

On August 26, 2020, the Stocks and Exchange Commission (the "SEC") embraced changes (the "Changes") to the personal placement interpretation of "accredited investor" in Law D under the Stocks Act of 1933 (the "Securities Act"). The SEC's key purpose of the Changes is to broaden the swimming pool of certified investors to include investors that have the understanding and know-how to evaluate the risks of illiquid privately used safeties.

501 Accredited Investor

The SEC considers this a clarification, rather than an expansion, as it planned that Guideline D show its historical SEC personnel analyses that LLCs were eligible to be recognized capitalists if they met the other requirements of the definition. If you want to review the results of the Modifications to your company or have questions, please call,,, or any kind of various other participant of our.

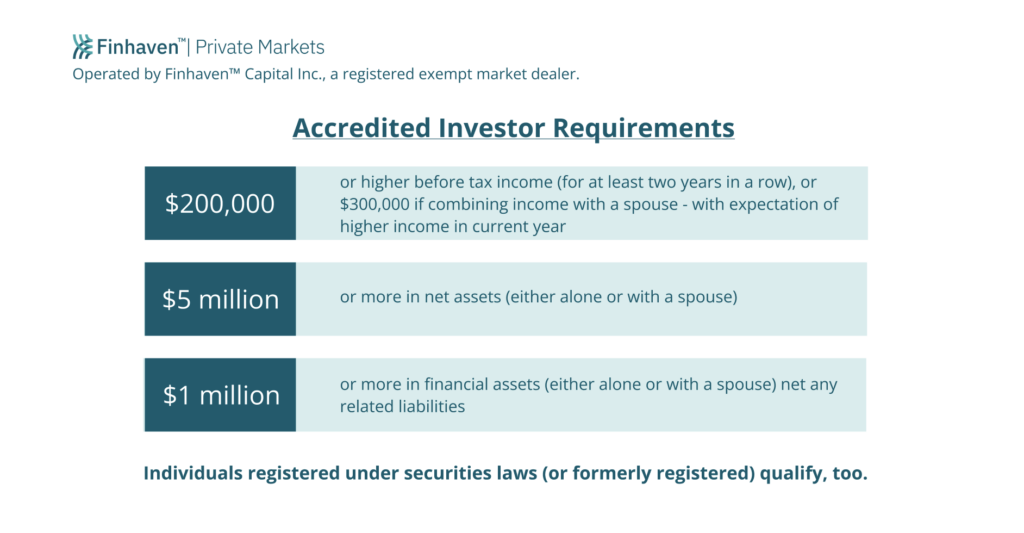

So, currently you know what qualifies you as an approved investor, you need to identify if you fit the demands. As mentioned above, you require to have a web worth that exceeds $1 million as a specific or joint with your partner to be considered approved. You may not include your main residence in your.

Qualified Investor Fund

However, if the loan on your main house is even more than the fair market price of the house, after that the finance amount that mores than the fair market price counts as a responsibility in your total assets estimation. Additionally, if there is a boost in the finance amount on your key home within 60 days of investing, it will certainly likewise count as obligation.

When determining your web worth, teams may ask you for financial statements, tax obligation returns, W2 forms or various other documents that program revenue. While there is no federal government policy of every individual certified investor; there are strict policies from the needing business like exclusive equity funds, hedge funds, equity capital companies, and others to take a number of actions to confirm the condition of an investor prior to collaborating with them.

In 2020, an approximated 13.6 million united state houses are accredited financiers. These houses manage huge wide range, approximated at over $73 trillion, which represents over 76% of all exclusive wealth in the united state. These capitalists join financial investment opportunities generally not available to non-accredited capitalists, such as investments secretive business and offerings by specific hedge funds, private equity funds, and endeavor capital funds, which enable them to grow their wealth.

Check out on for details about the newest certified investor alterations. Banks generally fund the majority, however hardly ever all, of the capital required of any kind of acquisition.

There are mostly two policies that permit providers of securities to provide limitless quantities of securities to capitalists - accredited investor 401k. One of them is Guideline 506(b) of Guideline D, which permits an issuer to market securities to unrestricted recognized financiers and approximately 35 Sophisticated Financiers just if the offering is NOT made with general solicitation and general advertising

Are You An Accredited Investor

The recently embraced changes for the first time accredit specific capitalists based on monetary sophistication requirements. The changes to the certified capitalist definition in Rule 501(a): include as certified investors any depend on, with overall properties a lot more than $5 million, not created specifically to buy the subject safeties, whose acquisition is directed by a sophisticated individual, or consist of as recognized investors any type of entity in which all the equity proprietors are approved financiers.

Under the government safety and securities laws, a firm might not supply or sell safeties to capitalists without enrollment with the SEC. Nevertheless, there are a variety of enrollment exemptions that eventually increase the universe of prospective capitalists. Numerous exceptions need that the financial investment offering be made just to individuals who are accredited investors.

Additionally, recognized capitalists often receive extra desirable terms and higher possible returns than what is offered to the basic public. This is because exclusive placements and hedge funds are not needed to abide by the same regulative requirements as public offerings, enabling for even more adaptability in terms of investment methods and prospective returns.

One reason these safety offerings are limited to approved capitalists is to guarantee that all taking part financiers are monetarily innovative and able to fend for themselves or maintain the risk of loss, hence providing unneeded the securities that come from an authorized offering.

The internet worth test is relatively straightforward. Either you have a million dollars, or you don't. On the earnings examination, the person has to please the limits for the three years regularly either alone or with a partner, and can not, for example, please one year based on individual earnings and the following 2 years based on joint revenue with a spouse.

Latest Posts

Struck Off Property

Petition For Release Of Excess Proceeds Texas

Delinquent Tax Services